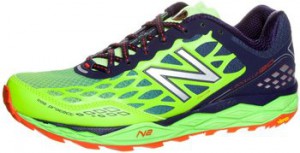

New Balance Leadville 1210

A  je to konečně tady. naběháno v těchto botkách už mám něco málo tak by mohlo být na čase se pustit do nich v trochu jiném kabátě. Pokud někdo z vás máte doma oblíbené křeslo či pohovku nebo jiný artikl, uvelebte se do něj a pojďme na to! Já se totiž v těchto bačkorách cítím úplně stejně již od prvního obutí jako vy ve svém oblíbeném křesílku. Opravdu je to jako spadnout do peřinek a to pěkně nadýchaných, už tedy ne zrovna moc voňavých...

je to konečně tady. naběháno v těchto botkách už mám něco málo tak by mohlo být na čase se pustit do nich v trochu jiném kabátě. Pokud někdo z vás máte doma oblíbené křeslo či pohovku nebo jiný artikl, uvelebte se do něj a pojďme na to! Já se totiž v těchto bačkorách cítím úplně stejně již od prvního obutí jako vy ve svém oblíbeném křesílku. Opravdu je to jako spadnout do peřinek a to pěkně nadýchaných, už tedy ne zrovna moc voňavých...

Bota sedí a padne, alespoň mně jako šitá na míru, což se mi stává skoro u všech modelů New Balance. Tlumení je dostačující, ovšem v ničem mě neomezuje ani nepřekáží, zkrátka akorát. Zkoušel jsem je na asfaltu, kočičích hlavách, kamenitých cestách, za sucha, mokra. Pokud hodnotím pohodlí pro nohy, opravdu je to botka velice pohodlná. Na silnici je stabilní, neklouže a drží pěkně. Nejvíce zabrat dostala teď na EPO Trail maniacs, což bylo 63km v celkem technicky náročném terénu, kde se snoubily běžné lesní cesty s kamenitými, uklouzanými úseky s blátem a několik brodíčků až po pořádný brod. Je jasné, že o lesních zpevněných cestách nemá cenu zmiňovat nic, neboť boty drží skvěle. Chvílemi jsem ani nevěděl, že mám něco na nohách. Když jsem se dostal k seběhům, výběhům mimo cesty, držely úplně perfektně, za celou dobu jsem se sklouzl jen jednou, a to po kameni, kde byl celkem proud v řece a vody lehce nad kolena. Když jsem našlápl nějaký kámen, podrželi mě a jsou velice stabilní. Dobře řešená podrážka se vzorkem, který nezklamal ani v hlubokém bahně. Tkaničky mi držely zavázané i po proběhnutí křovisek a ostružiní, o nohách se to říci nedalo, ty byly celé podrápané. Na svršku není znát nic, jen z jedné tkaničky mám malinko vytaženou jednu nitku, ale to by se stalo u všech bot z takové trati. Celkové hodnotím tuto botu jako opravdu podařenou a nebál bych se v ní uběhnout jakoukoliv vzdálenost s jakýmkoliv terénem. Mohu jen doporučit, i když byly mokré z řeky, stále držely, voda odtekla hned a nijak neztěžkly, oproti jiným botkám, ve kterých jsem měl tu čest již běhat. Takže sem s traily, myslím, že jsme připraveni, i když NB Leadvillky více než já :D.

Komentáře

Přehled komentářů

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamaruida, 6. 3. 2024 23:49)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(Lamaruida, 6. 3. 2024 18:25)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamaruida, 6. 3. 2024 13:38)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamaruida, 6. 3. 2024 9:18)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamaruida, 6. 3. 2024 4:27)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

can I ask you something?

(GeorgeFap, 6. 3. 2024 3:01)

https://contactmeasap.com/blog/17-indications-you-work-with-key-word/

https://contactmeasap.com/blog/fifteen-plain-good-reasons-to-like-keyword/

https://contactmeasap.com/blog/seventeen-indicators-youre-employed-with-key-word/

https://contactmeasap.com/blog/17-symptoms-you-work-with-search-term/

https://contactmeasap.com/blog/federal-inmate-text-company/

BITCOIN MONEY SEARCH SOFTWARE

(Lamaruida, 5. 3. 2024 23:40)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

The Quint News Today

(Herbertnib, 5. 3. 2024 20:27)

All exclusive news stories, opinions and analysis on politics, sports, entertainment, health, business, gender and culture and much more.

https://www.thequintnewstoday.com/

SEARCHING FOR LOST BITCOIN WALLETS

(Lamaruida, 5. 3. 2024 17:56)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(Lamaruida, 5. 3. 2024 12:00)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamaruida, 5. 3. 2024 5:39)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(Lamaruida, 5. 3. 2024 0:05)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(Lamaruida, 4. 3. 2024 15:51)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Where to buy Roman blinds?

(Eddieunmar, 4. 3. 2024 15:47)

We invite you to experience our vertically integrated Canadian shade store, where innovation and artistry intertwine to create unrivaled beauty.

I buy here https://loganova.com/

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaruida, 4. 3. 2024 9:21)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(Lamaruida, 4. 3. 2024 3:22)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Forex market

(Jamenvolve, 4. 3. 2024 0:17)

Jump to search

Speculate on market Forex?

Best exclusive offer 2024 for common speculators, software developers, traders, trading signal sellers, trading advisor sellers, trading account managers, investment companies, large brokerage firms , as well as for everyone who dreams of opening their own business on the Forex market with minimal investments.

We will be happy to Give away MetaTrader4 Server for 0Give away MetaTrader4 Server for 0/en/products.html

More in detail watch here:

https://drive.google.com/file/d/14xuST2EFDKcnfUT_dL49jQu0Asj1uJx4/view?usp=sharing

Curiously....

(Eugenenor, 3. 3. 2024 21:39)

What entertaining message

guardianship

mmfporn.com/tags/soft-to-hard/

@456FgDDY8

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaruida, 3. 3. 2024 21:22)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 | 71 | 72 | 73 | 74 | 75 | 76 | 77 | 78 | 79 | 80

BITCOIN CRACKING SOFTWARE

(Lamaruida, 7. 3. 2024 4:40)